Why Are Health Insurance Premiums Going Up?

Health insurance is expected to cost even more in 2026. Here’s what’s going on – and some other options to get quality care.

by Caylin Cheney, Advanced Registered Nurse Practitioner

If you have started to look into health insurance for 2026 and gotten major sticker shock, you’re far from alone. Whether you get your insurance through the marketplace or from your employer, odds are that the premium is much higher than it’s been in years past.

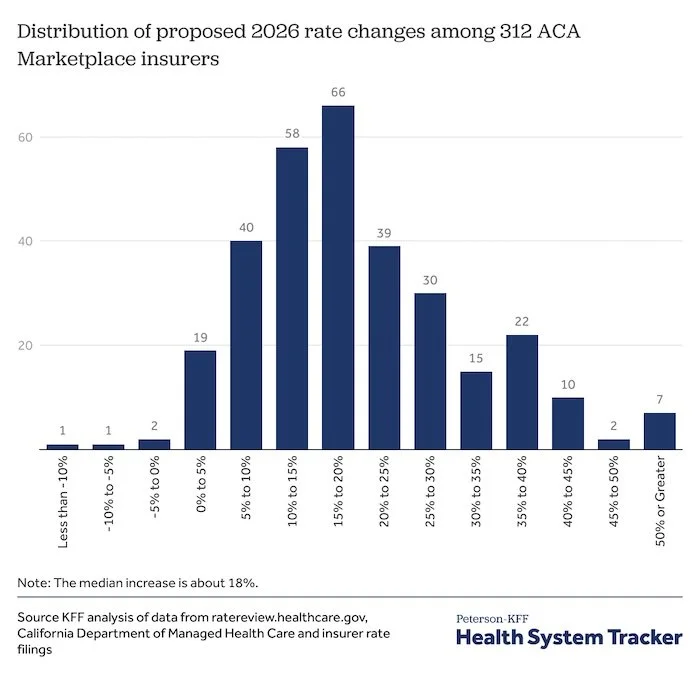

In fact, plans bought on the Affordable Care Act Marketplace are 18% higher this year (at the median), but some people are seeing the cost of their plans go up a staggering 59%. And that’s before you factor in expiring tax credits as the government no longer pays its share of your plan (more on that below).

So, why exactly is the cost of health insurance skyrocketing – especially when it’s sky high already? To be clear: There are a lot of factors at play because the system is massive and complex. But I want to breakdown two that are top of mind for me:

1. Tax credits are expiring

Millions of people in the United States are on ACA health care plans (rather than plans that an employer would provide in a benefits package). Just like a company pays for some of your premium, in the past the government would also help subsidize some of the cost for an ACA plan with tax credits. However, those Enhanced Premium Tax Credits are set to expire at the end of 2025.

That means that those who have a plan purchased on the marketplace will have to pay the entire rate of insurance starting in 2026, if nothing changes in Congress soon. So even if the actual insurance plan doesn’t cost much more (though it likely does), what you are paying may be significantly higher.

But base costs are rising. Here in Washington state, 300,000 people depend on the marketplace and will see a 21% increase in rates on average. It’s a double whammy: the actual amount people are paying out of pocket is going up tremendously since the government isn’t paying its part any longer and the baseline price is higher than ever.

For example, people in King County could see a 94% increase in their premium overall – meaning premiums are nearly doubling. If you pay $400 for insurance each month now, for example, it could climb to $776 per month according to the data.

2. Health care costs are increasing broadly

The issue of credits expiring is specific to people who get their plans from the ACA marketplace, but if you have insurance from your job or Medicare, you’re likely to see the cost increase, too. What’s going on?

Insurance companies point to rising health care costs across the board as reasoning for why they are increasing the baseline cost of plans. These companies cite:

The rising demand and cost of new specialty drugs;

The fact that medical inflation is outpacing general inflation;

The high cost of taking care of an aging population;

Consolidation of health systems and less competition; and more

While all of this may be a reality, it’s important to remember a few other underlying reasons why health insurance is getting more expensive: Insurance companies are fundamentally looking out for their shareholders – prioritizing profits over patients. These companies also spend a lot of money influencing legislation rather than paying for care. And they incentivize lots of care, not quality care, too. All of these factors together make it more and more expensive to get the care you need.

Whole Person Well Care offers other options

I want to be clear: I would never tell any of my patients to get rid of their health insurance. Choices about insurance – like any health care decision – are deeply personal and based on your specific medical and financial circumstances.

But at Whole Person Well Care, I have options that, for some people, could be more affordable and more accessible in the wake of rising premiums. I’m able to offer these options as a practitioner that doesn’t take insurance – existing at least somewhat outside of the typical system. This model is called direct primary care, where patients pay their healthcare provider directly, removing insurance and middlemen.

Individual visits ($200 per visit): If you’re looking for one-time or occasional care, this option is perfect for you. Whether something urgent comes up or you just want a yearly wellness check-in, you’ll receive the time, attention, and support you deserve.

Primary care membership ($150 per month): This is ongoing, relationship-based care. It’s focused on building trust, honoring your autonomy, and creating a space where you feel safe, supported, and fully seen! This includes same-day appointments, direct messaging, health coaching, and more.

Whichever option you choose, you’ll get transparent, inclusive care that meets you where you are. If this sounds like something you would like to learn more about, get in touch or schedule a visit today.